Top Reasons Why Bitcoin Price May Retest $92k First Before Reaching $120k in the Midterm

The post Top Reasons Why Bitcoin Price May Retest $92k First Before Reaching $120k in the Midterm appeared first on Coinpedia Fintech News

Bitcoin (BTC) price has experienced heightened resistance around $108k in the past few days amid the de-escalation of the Middle East crisis. The flagship coin dropped slightly to trade at about $107,472 on Thursday, June 26, during the mid-North American session.

After recording an impressive comeback, following the 90-day pause on most reciprocal tariffs in April, BTC price has been forming a potential reversal pattern. The bearish sentiment for BTC price has been forming amid the growing demand from institutional investors, led by Strategy, and Metaplanet.

Major Factors Weighing Down on Midterm Bullish Sentiment for Bitcoin Price

Technical Headwinds

The BTC price, in the daily timeframe, has been forming a falling trend following a bearish breakout from a rising wedge formed in late May 2025. The midterm bearish sentiment for BTC price is bolstered by the falling daily Relative Strength Index (RSI) with the MACD line having crossed below the zero line.

From a technical analysis standpoint, BTC price is well-positioned to retest the support level above $92k again in the coming weeks. The ultimate support level for BTC price was established above $76k earlier this year.

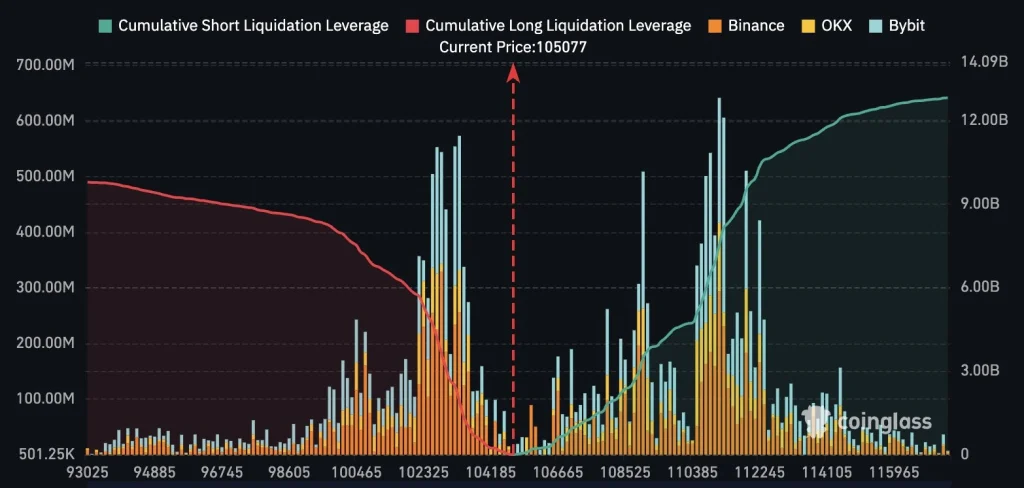

High Cumulative Short Liquidation Leverage

Bitcoin price faces intensified bearish sentiment fueled by cumulative short liquidation leverage of about $12 billion around $112k. Ideally, it is safe to say that more institutional investors are seeking to suppress BTC price through the futures and leveraged markets to acquire as many coins as possible before the highly anticipated parabolic rally.Furthermore, on-chain data shows that institutional investors have been aggressively accumulating more BTC through leveraging equity markets. According to market data from BitcoinTreasuries, 251 entities hold more than 3.47 million BTCs in their respective treasuries.