Shiba Inu (SHIB) Surpasses Bitcoin (BTC) and Ethereum (ETH) in This Key Metric: Details

TL;DR

- Shiba Inu boasts a strong holder base, with a big chunk of its 1.5 million+ investors holding the asset for over a year.

- Despite a 9% weekly dip, SHIB may be primed for a rebound, fueled by a spike in token burns, the advancement of Shibarium, and rising exchange outflows.

SHIB is Ahead on This Front

Shiba Inu (SHIB) was launched in the summer of 2020 as a meme coin with a dubious utility and largely driven by community hype. In the past few years, though, the project evolved into a more ambitious ecosystem with serious development goals.

This could be among the reasons why the self-proclaimed Dogecoin killer is one of the most popular cryptocurrencies, with the number of its holders recently exceeding 1.5 million.

A thorough look at IntoTheBlock’s data shows that around 78% of those investors have hopped on the bandwagon more than a year ago. 20% have done so in the last 12 months, whereas only 2% have entered the ecosystem in the last 30 days.

In comparison, around 75% of Bitcoin (BTC) holders have held their assets for over a year – a figure that’s nearly identical for Ethereum (ETH) investors.

The large share of long-term Shiba Inu holders signals a committed investor base, which is typically considered less likely to sell impulsively during turbulent times.

It’s worth noting that a significant portion of these investors could have entered the market in 2021 when SHIB skyrocketed to prominence amid its explosive price surge. With the token now trading well below those peak levels, many of them may be currently sitting at unrealized losses.

According to IntoTheBlock’s data, almost 60% of all Shiba Inu investors remain underwater. 37% are in the green, while 4% are breaking even.

Time for a Pump?

While SHIB’s price has suffered a 9% weekly decline, certain elements hint at an upcoming resurgence.

One example is the burn rate, which has increased by over 350% in the last seven days. The total amount of scorched tokens since adopting the program in 2022 is more than 410 trillion, meaning there are around 584.4 trillion in circulation, according to this SHIB tracker.

Reducing the overall supply makes the asset more scarce and could make it more valuable. However, this needs to be combined with a non-declining demand.

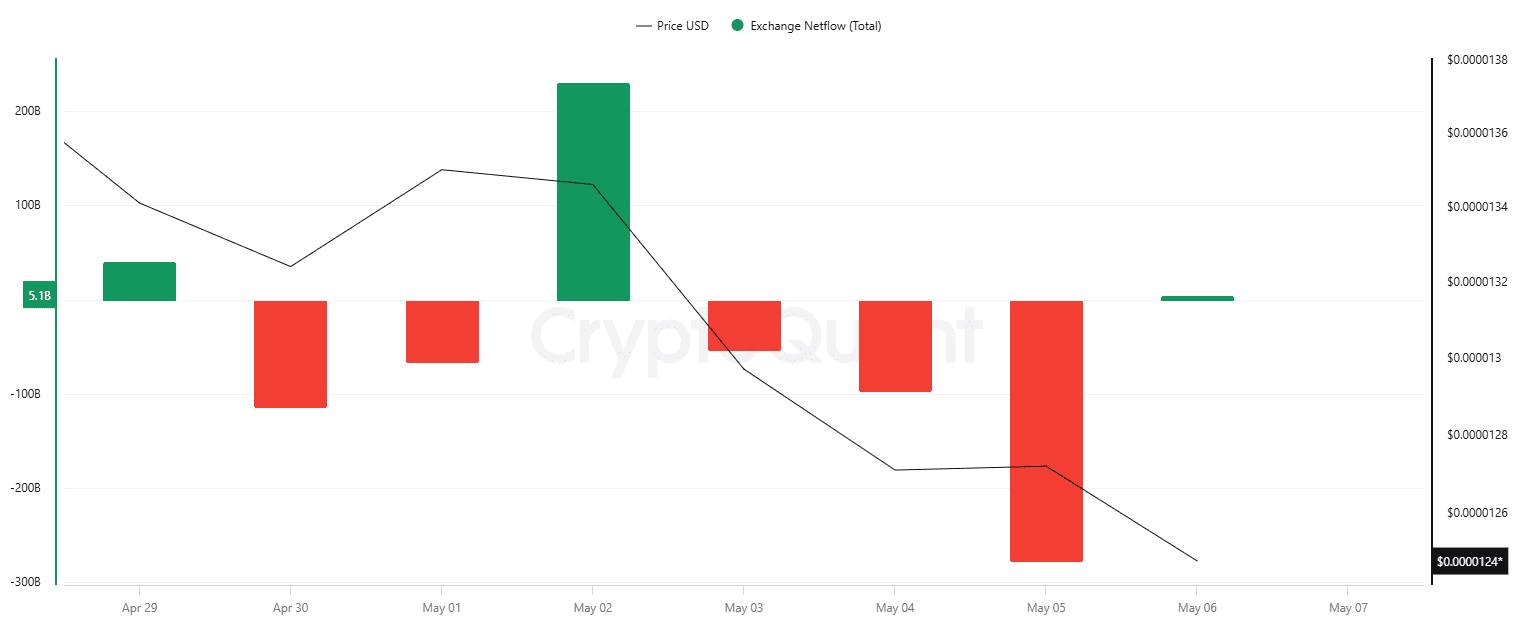

Other factors suggesting a possible revival are the development of Shibarium and the recent SHIB exchange netflow. The layer-2 blockchain solution has recently passed numerous major milestones, with some industry participants predicting a significant price jump for the meme coin in the event of further advancement.

For its part, SHIB exchange outflows have dominated inflows in the past several days, signaling a shift toward self-custody methods and reduced selling pressure.

The post Shiba Inu (SHIB) Surpasses Bitcoin (BTC) and Ethereum (ETH) in This Key Metric: Details appeared first on CryptoPotato.