Healthcare Pioneer Semler Scientific Bets Big on Bitcoin with $40 Million Investment

Semler Scientific, a pioneer in healthcare technology, has demonstrated its forward-thinking approach by adopting Bitcoin as its primary treasury reserve asset.

The company’s decision to purchase 581 Bitcoins for $40 million, including fees, showcases its confidence in the future of digital currencies.

Semler Sees Bitcoin as Digital Gold

Semler Scientific’s Chairman Eric Semler highlighted Bitcoin’s digital resilience, making it preferable to gold, which has a market value ten times that of BTC. He believes the oldest cryptocurrency could generate outsized returns as it gains acceptance.

“Our Bitcoin treasury strategy and purchase underscore our belief that BTC is a reliable store of value and a compelling investment. Bitcoin’s unique characteristics as a scarce and finite asset make it a reasonable inflation hedge and haven amid global instability,” Semler said.

Investing in BTC aligns with the company’s proactive financial management. As Semler Scientific generates revenue and free cash flow from QuantaFlo® sales, it will continue evaluating the best use of its excess cash. Bitcoin will be the principal treasury holding, subject to market conditions and the company’s anticipated cash needs.

Read more: Bitcoin Price Prediction 2024/2025/2030

The company indicated the decision follows increasing institutional acceptance of Bitcoin. This trend includes the approval of 11 BTC exchange-traded funds (ETFs) by US regulator in January 2024. American ETFs reported over $13 billion in net inflows, with investments from nearly 1,000 institutions, including global banks, pensions, endowments, and registered investment advisors.

Over 10% of all Bitcoins are now held by institutions. Bitcoin ETFs have reached a significant milestone, holding over 1 million BTC, nearly 5% of Bitcoin’s total supply.

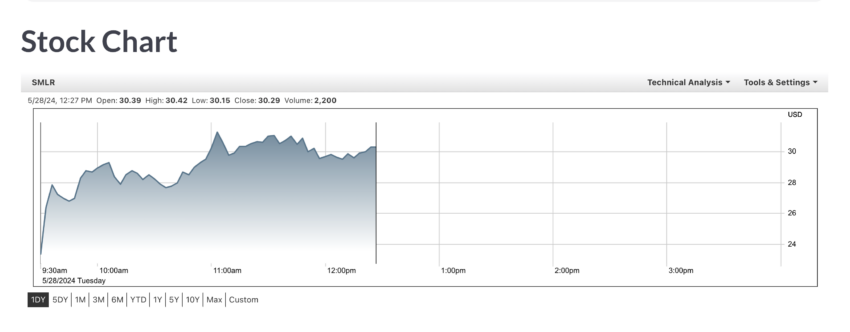

The announcement of Semler Scientific’s Bitcoin investment immediately boosted the company’s stock. It saw a 27% increase during early US trading hours on Tuesday. This significant rise, coupled with the company’s strong financial performance, highlights the positive outlook for Semler Scientific.

Other companies purchasing Bitcoin have also seen stock impacts. Metaplanet Inc., known as “Japan’s MicroStrategy,” outperformed every other company on the Japanese stock market last week. Metaplanet’s shares rose 50%, from ¥41 at Monday’s close to ¥90, marking two consecutive gains. Recently, the firm announced plans to buy another ¥250 million worth of Bitcoin.

The post Healthcare Pioneer Semler Scientific Bets Big on Bitcoin with $40 Million Investment appeared first on BeInCrypto.