Gary Gensler: Next Step in Ethereum ETF Approvals ‘Will Take Some Time’ – Will Trading Start on July 4th?

- SEC Chair Gary Gensler indicated in a recent CNBC interview that the approval process for spot Ethereum ETFs could take longer than anticipated, with S-1 registrations unlikely to be approved imminently.

- Ethereum’s open interest in derivatives products has surged by 50.3% to $14 billion, setting a new record, with notable increases on the Chicago Mercantile Exchange.

While everyone has been eagerly awaiting the launch of the spot Ethereum ETFs, SEC chief Gary Gensler recently said in a CNBC interview that the reviewing time for the S-1 registrations could be longer than expected.

NEW: @SECGov Chairman @GaryGensler says the next step in the $ETH ETF approvals “will take some time,” possibly indicating a potential slow-walk of the S-1 approval process. https://t.co/iwfN9vvmt8

— Eleanor Terrett (@EleanorTerrett) June 5, 2024

In an interview with CNBC on Wednesday, SEC Chair Gary Gensler stated that spot ETH ETFs would “take some time” before being approved for exchanges, indicating that S-1 approvals are not imminent. He mentioned that the agency is still working on disclosure measures with exchanges. He said:

“Ethereum had been traded on the Chicago Mercantile Exchange futures for three-plus years. And the staff looked at that closely, and that was approved. Now, the underlying exchange traded products (ETPs) still need to go through a process to have the disclosure about that. That will take some time, but they’re working on that right now.”

Last Friday, top industry giants VanEck and BlackRock submitted their S-1 drafts amid the submission deadline, as reported by Crypto News Flash. Several industry insiders believe there will be at least two rounds of draft filings before the SEC makes a final decision.

Unlike the relatively straightforward approval process for Bitcoin ETFs, the altcoin market faces more uncertainty, according to market observers. While unanimous approval could be a significant milestone, recent developments have added to the ambiguity. For instance, Hashdex’s withdrawal of its Ethereum ETF application for undisclosed reasons has raised questions about the future of Ethereum ETFs.

Ethereum Open Interest Shoots 50%, Will ETH Price Follow?

According to the CCData Exchange Review for May, Ethereum’s open interest (OI) in ETH derivatives products on exchanges has soared to a new record high, climbing by 50.3% to $14 billion. Particularly noteworthy is the surge in open interest on the Chicago Mercantile Exchange (CME), which spiked by 59.4% to $1.25 billion.

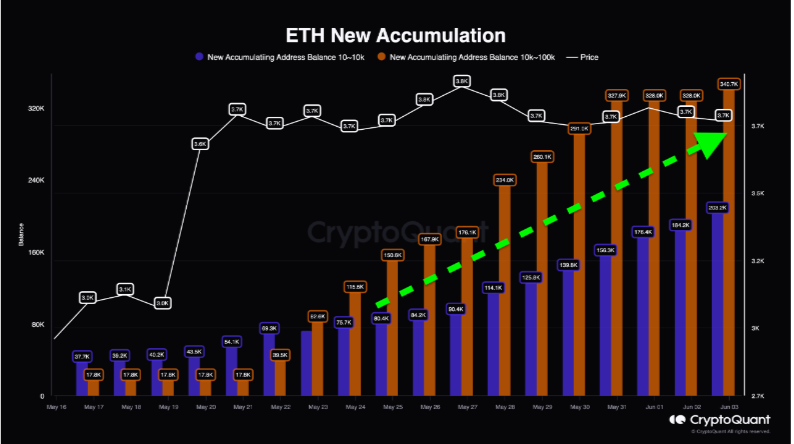

Simultaneously, data from CryptoQuant reveals a steady increase in the balance of new accumulating addresses holding between 10 to 10K and 10K to 100K ETH since the SEC’s shift in stance regarding ETH ETFs.

Ethereum experienced a slight gain on Wednesday, trading near $3,860 and maintaining its sideways trend.

The $3,618 price level remains a key support for short-term price fluctuations. In the long term, ETH could surpass the $4,093 resistance and potentially reach a new all-time high of around $5,000 by flipping the $4,878 level, as reported by Crypto News Flash.

QCP Capital analysts also share this bullish outlook: “ETH has been lagging in this move, but we expect it to catch up and possibly even outperform BTC once the ETH spot ETF begins trading,” they stated.

NEW:

NEW: