Ethereum Price Analysis: ETH Shows Early Signs Market Exhaustion After Rejection at $1,850

Ethereum is currently consolidating below a major resistance area after rejecting at the $1,850 zone. While the price is holding relatively stable, the momentum is weakening.

Open interest and funding data point to cautious optimism, but upside continuation depends on the buyers defending key short-term levels.

Technical Analysis

The Daily Chart

Following the aforementioned rejection at the supply zone, ETH has stalled in a consolidation area with diminishing momentum. The price is still trapped below both the 100-day and 200-day moving averages, which continue to slope downward, signaling bearish macro structure.

The recent rally from $1,500 was strong but lacked follow-through, and the price failed to close above the $1,900 zone. If ETH loses the $1,700 pivot, the next major support sits around $1,500K, which acted as the base of the prior reversal.

The 4-Hour Chart

The local structure has evolved into an ascending channel, with price currently dropping toward its lower boundary after failing to break the $1,800 resistance zone.

The rejection from the upper bound of the channel and the false breakout above resistance triggered a sharp pullback, suggesting buyer exhaustion. Now, ETH is retesting previous demand around $1,740, and if that breaks, a rapid decline toward the $1,500 level could be expected.

Sentiment Analysis

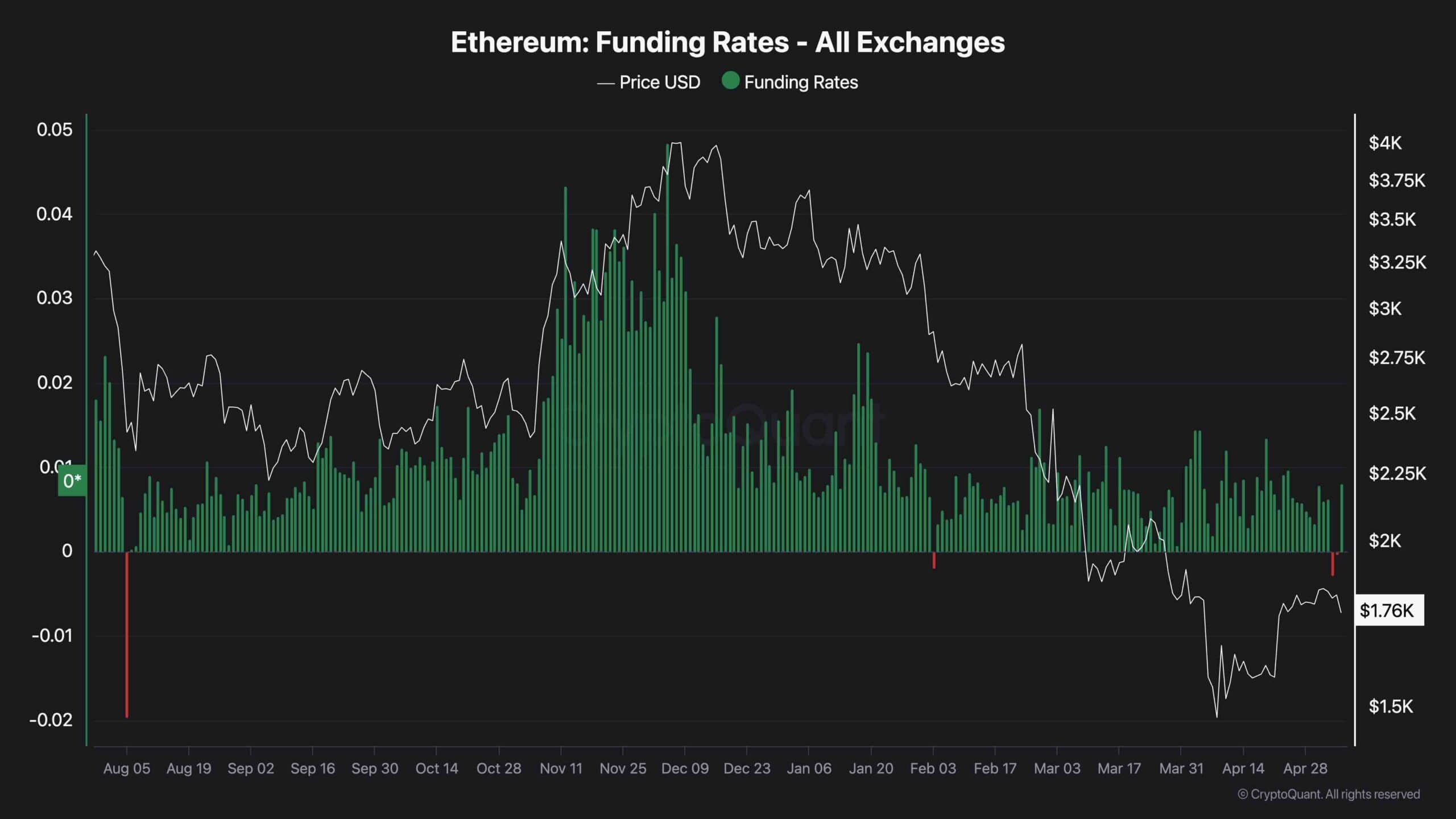

Funding rates remain mostly neutral, with a slight positive bias across exchanges. This reflects a lack of aggressive long exposure, which is healthy for future rallies but doesn’t signal immediate bullish conviction.

Open interest has picked up slightly over the last few days, suggesting renewed participation, but it’s still far from euphoric levels. As long as open interest builds while price compresses, there’s a higher risk of a liquidation event unless buyers step in with force.

On the other hand, ETH’s current funding rate structure suggests that most participants are still waiting on the sidelines. The absence of heavily skewed long or short positioning indicates the market is in balance, but vulnerable to rapid sentiment shifts.

If the asset continues to hover under resistance, aggressive traders may begin fading long setups, leading to downward pressure. However, any sudden upside breakout above the $1,900 area could catch the market off guard, triggering a wave of short covering. Until then, sentiment remains cautiously neutral with a slight bearish tilt in the short term.

The post Ethereum Price Analysis: ETH Shows Early Signs Market Exhaustion After Rejection at $1,850 appeared first on CryptoPotato.