BREAKING: Can Chinese Users Buy Bitcoin and XRP Using ByBit, the Third Largest Offshore Exchange, Which Just Opened Trading for Chinese People?

- Bybit allows Chinese users to register, reversing its strict ban, reflecting a shift in its operational policy.

- Bybit’s move to allow Chinese users raises internal concerns about potential regulatory repercussions and compliance challenges.

Bybit, the world’s third-largest offshore cryptocurrency exchange, has recently allowed users in China to register and authenticate on its platform. This decision marks a shift from Bybit’s long-standing policy of prohibiting Chinese users, reflecting a cautious approach by its management team.

Despite the previous restrictions, data suggests that the number of potential Chinese users could reach tens of millions. Many of Bybit’s competitors have already opened registration to this market, which may have influenced Bybit’s recent decision. However, this move has created internal concerns among Bybit’s employees, who are wary of potential regulatory repercussions.

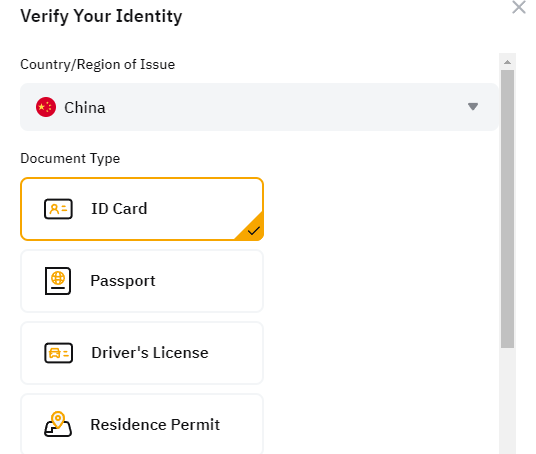

Interestingly, Bybit’s certification page still lists China among the jurisdictions where it does not offer services. This inconsistency highlights the complex regulatory sector in which Bybit operates. In addition to China, Bybit restricts its services in the United States, Singapore, Quebec, Ontario, Iran, Sudan, and Syria.

Our editor-in-chief and cryptocurrency analyst has shared his point of view, reflecting how important and remarkable this would be for the trading community.

BREAKING: Bybit Opens Registration for Chinese Users to buy #Bitcoin and #XRP!

In a surprising twist, Bybit, the third-largest offshore exchange, has just lifted its long-standing ban on user registration from China. This sudden change comes after a period of strict… pic.twitter.com/fM287XxOGM

— Collin Brown (@CollinBrownXRP) June 5, 2024

Bybit’s regulatory challenges are not confined to China

The company recently withdrew its application for a license in Hong Kong, where stringent regulations have made it difficult for cryptocurrency firms to operate. Hong Kong prohibits entities from conducting business in mainland China, suggesting that Bybit might abandon its plans for a Hong Kong license altogether. Currently, Bybit is headquartered in Dubai, a move that may have lessened its regulatory pressures from China.

Exclusive: The third largest offshore exchange Bybit suddenly opened up registration and authentication for users in China. Bybit has long strictly prohibited the registration and use of all Chinese users. The management team has been very cautious about this. pic.twitter.com/m71BdT4KAq — Wu Blockchain (@WuBlockchain) June 5, 2024

Bybit’s operational shift from Singapore to Dubai might be another factor influencing its decision to reopen registration for Chinese users. The less stringent regulatory environment in Dubai could provide Bybit with more flexibility in managing its global operations.

Chinese users have continued to access Bybit’s services by bypassing VPN firewalls, acquiring accounts from other regions. This workaround has been a common practice, reflecting the persistent demand from Chinese residents to participate in cryptocurrency trading.

Bybit withdrew its application for a Hong Kong license earlier. Hong Kong does not allow any entity to develop business in mainland China. This also means that Bybit may give up applying for a Hong Kong license. Currently, Bybit is headquartered in Dubai.

— Wu Blockchain (@WuBlockchain) June 5, 2024

Bybit’s regulatory troubles extend beyond China and Hong Kong

In France, the Autorité des Marchés Financiers (AMF) has accused Bybit of operating without the necessary license. This incident underscores the fragmented and challenging legal environment that international cryptocurrency exchanges face as they navigate different regulatory frameworks.

Bybit’s reopening to Chinese users amid these regulatory challenges highlights the complexities and risks associated with global cryptocurrency operations. The company’s actions suggest a strategic balancing act, attempting to expand its user base while managing compliance with varying international regulations.

BREAKING: Bybit Opens Registration for Chinese Users to buy

BREAKING: Bybit Opens Registration for Chinese Users to buy