BlackRock Surpasses Grayscale’s GBTC to Become World’s Largest Spot Bitcoin ETF

In a notable shift in the crypto market, BlackRock’s iShares Bitcoin Trust (IBIT) has overtaken Grayscale Bitcoin Trust (GBTC) to become the world’s largest spot Bitcoin exchange-traded fund (ETF).

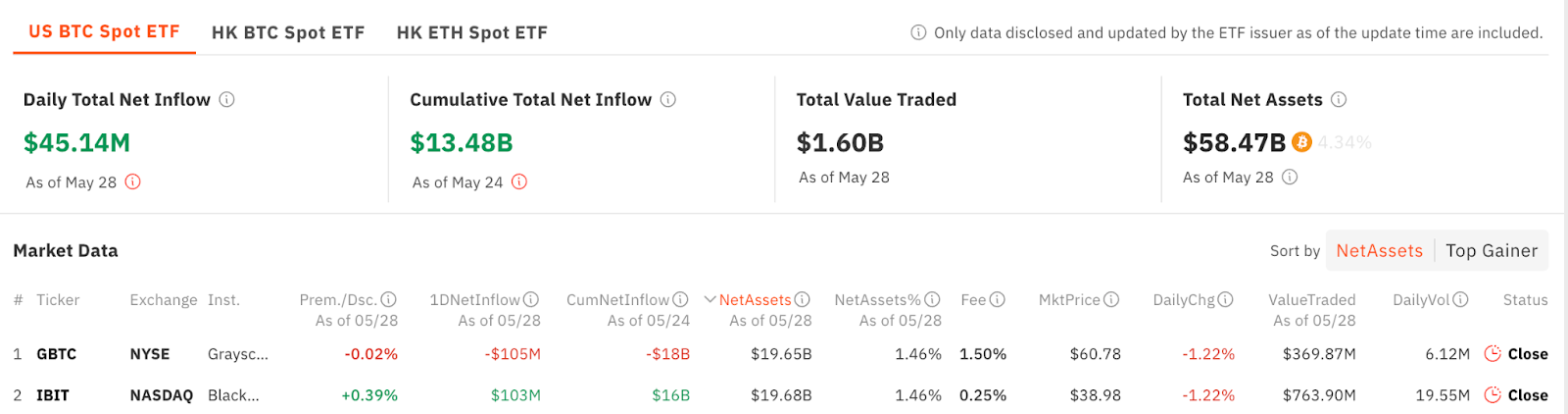

Recent data from SoSoValue shows that IBIT now holds $19.68 billion in Bitcoin (BTC), slightly edging out GBTC’s $19.65 billion.

How Grayscale’s GBTC Lost Its Top Spot to BlackRock’s IBIT?

This milestone, occurring 96 trading days after the approval of spot Bitcoin ETFs, marks the beginning of a significant era for crypto-financial products.

Grayscale charged a 1.5% fee for the GBTC ETF, which is significantly higher than its competitor’s. Hence, Grayscale gradually lost appeal among investors as they preferred alternatives such as BlackRock’s IBIT.

“Grayscale held 620,000 BTC at the time of the conversion (January 10, 2024), which was more than 3% of circulating supply, but refused to lower the fee (1.5% vs 0.2% for peers), even after investors pulled 330,000+ BTC. So much for the “differentiated” strategy,” HODL15Capital said.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Consequently, BlackRock’s achievement highlights the growing institutional interest in Bitcoin and the competitive dynamics within the ETF market.

Meanwhile, GBTC experienced its largest single-day outflow in 18 trading days, totaling $105 million. However, this reduction contrasts with the overall positive trend in the Bitcoin ETF sector, which saw a net inflow of $45.14 million on May 28, 2024. This extends an 11-day streak of net inflows across 11 US Bitcoin ETFs.

Additionally, BlackRock has leveraged its own income and bond-focused funds to invest in IBIT. The BlackRock Strategic Income Opportunities Fund (BSIIX) and the Strategic Global Bond Fund (MAWIX) purchased shares worth $3.56 million and $485,000, respectively, according to recent Securities and Exchange Commission (SEC) filings. Despite this, these investments represent only a fraction of their respective portfolios.

Further broadening the perspective, the total holdings of Bitcoin by ETFs have now surpassed 1 million BTC, constituting nearly 5% of the total Bitcoin supply. This milestone indicates the scale and impact of ETFs within the broader Bitcoin market.

Regionally, the US remains the focal point for Bitcoin inflows, which reached $1.03 billion last week. Moreover, other European countries like Germany and Switzerland also reported significant inflows.

Read more: Crypto ETN vs. Crypto ETF: What Is the Difference?

CoinShares data reflects an overall positive sentiment in the market despite volatile price movements. Digital asset investment products recorded inflows for the third consecutive week, totaling $1.05 billion. This surge in activity pushed the total value of digital asset exchange-traded products (ETPs) close to $98.5 billion.

The post BlackRock Surpasses Grayscale’s GBTC to Become World’s Largest Spot Bitcoin ETF appeared first on BeInCrypto.