Bitcoin Surges Past $71,000 as Institutions and Economic Data Boost Confidence

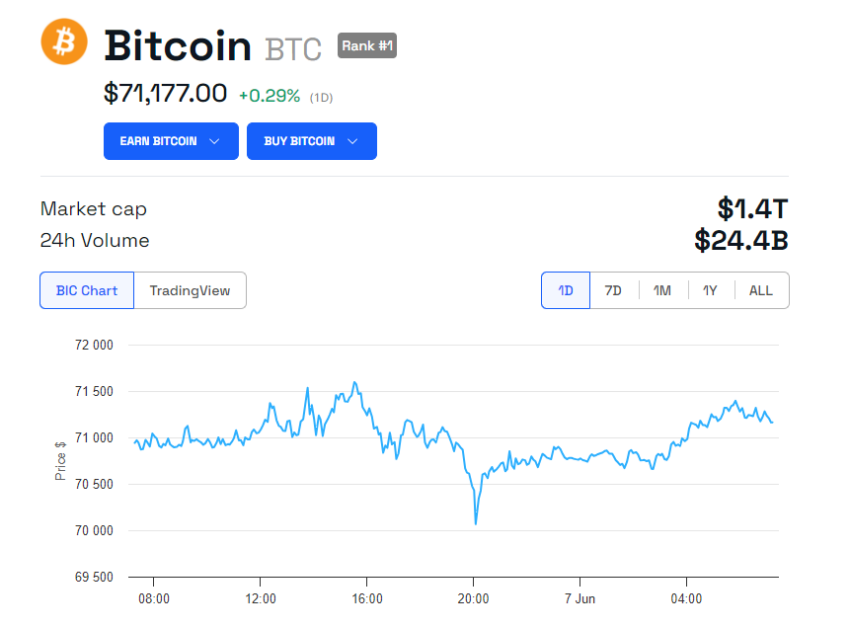

Bitcoin (BTC) has recently experienced a significant boom, reaching over $71,000 due to positive macroeconomic indicators and rising interest from institutional investors.

This surge, the longest in three months for the cryptocurrency, stems from anticipation of potential rate cuts by the Federal Reserve. Such adjustments could favor speculative assets like Bitcoin.

Institutional Confidence Bolsters Bitcoin’s Resurgence

Market optimism has grown regarding the Federal Reserve’s potential lowering of interest rates this year. Traders now see a higher likelihood of a rate cut as early as November.

This shift follows reports indicating slowing US inflation and a weaker jobs market, alongside notable dips in some Treasury yields. Financial conditions seem easing, which could benefit speculative investments, including cryptocurrencies. At the time of writing, Bitcoin’s value hit $71,177, an over 4% increase over the last week.

Read more: 7 Best Crypto Exchanges in the USA for Bitcoin (BTC) Trading

Banks such as JPMorgan Chase & Co. and Citigroup Inc. predict the Federal Reserve might reduce rates as soon as next month. Despite previous skepticism in April, traders now expect stable rates until November.

However, the recent trend suggests a possible quicker adjustment. The globe’s bond market has also seen its most prolonged rally since December.

This Friday’s employment data release is pivotal before next week’s Fed rate-setting meeting. It will reveal whether traders or banking forecasters better align with the Fed’s monetary policy direction.

Amid these developments, Bitcoin attracts institutional buyers like Semler Scientific (SMLR). Pending market conditions, the healthcare company decided to make Bitcoin its primary treasury asset.

It acquired 581 Bitcoin for $40 million, bringing its total holdings to 828 Bitcoin worth $57 million. Semler Scientific views Bitcoin as a stable value store and worthwhile investment. The company appreciates its scarcity and potential as an inflation hedge.

“We believe that Bitcoin’s unique attributes discussed above not only differentiate it from fiat money, but also from other cryptocurrency assets, and for that reason, we have no plans to purchase cryptocurrency assets other than Bitcoin,” the company stated.

Additionally, crypto-focused firms are also showing optimism. Bybit, a global crypto exchange, reportedly would allow Chinese expatriates to open accounts and trade.

This move aims to meet the growing demand for secure and user-friendly crypto trading solutions among the Chinese diaspora and worldwide Chinese communities. The development occurred following reports on Wednesday suggesting that Bybit may have facilitated signup and verification processes for users located in China despite the country’s well-known ban on Bitcoin.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

These activities are part of a broader pattern in which major financial organizations and crypto companies strategically position themselves to take advantage of Bitcoin’s potential. This is a strong indication of the increasing optimism regarding the future of this cryptocurrency.

The post Bitcoin Surges Past $71,000 as Institutions and Economic Data Boost Confidence appeared first on BeInCrypto.