Bitcoin Price Analysis: Low Speculative Urgency Signals More Pain In the Midterm

The post Bitcoin Price Analysis: Low Speculative Urgency Signals More Pain In the Midterm appeared first on Coinpedia Fintech News

Bitcoin (BTC) price has experienced faded bullish sentiment in the recent past as traders factor in external factors led by the Middle East crisis and the U.S.-led trade wars. The flagship coin has struggled to rally beyond $108k in the weekly timeframe, thus signaling possible midterm weakness.

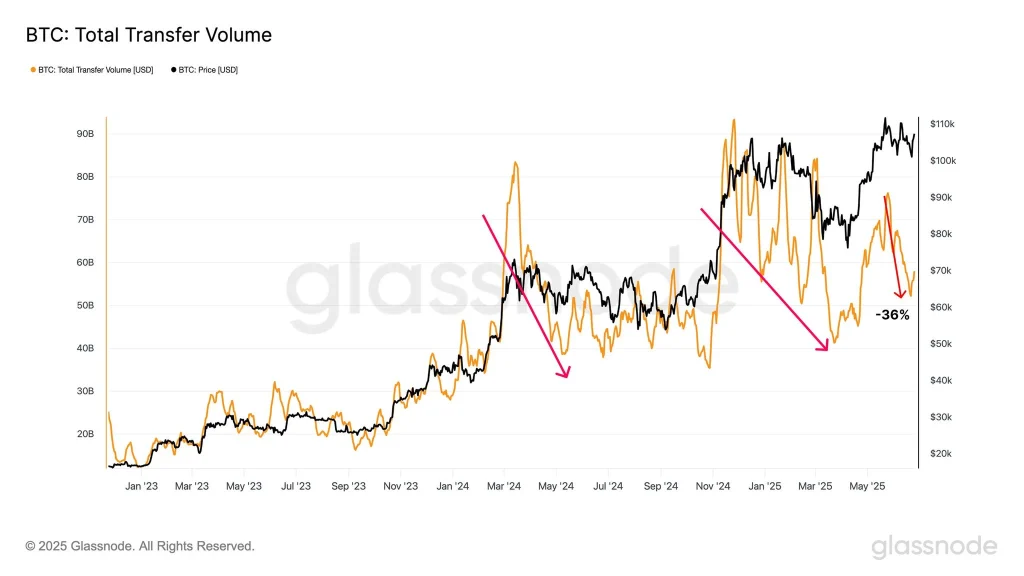

Although institutional investors, led by Strategy and Metaplanet, have continued to relentlessly accumulate more BTCs, market data shows the appetite for long exposure has faded over time. According to market data from Glassnode, Bitcoin’s spot volume has hovered at around $7.7 billion in the recent past, far below the prior peaks.

Why Traders Are Cautious About Bitcoin Price Consolidation

Bitcoin price has failed to record similar bullish gains as Gold (XAUUSD) in the past few months despite the U.S. dollar losing around 10 percent in value since President Donald Trump took office earlier this year. The short-term market uncertainty caused by the sharp differences between the Federal Reserve and the government of the day on Interest rates has reduced the overall BTC speculation.

According to Aksel Kibar, a popular classical chart trader, the BTC price has gradually formed a potential head and shoulders (H&S) pattern in the weekly timeframe. Although the buyers have been attempting to push higher in the recent past, Kibar highlighted that BTC price must consistently close above $109k in the weekly timeframe to confirm bullish momentum.

With the poor performance of the trade negotiations between the United States and other nations led by Canada, Japan, and the European Union, the BTC price faces a midterm bearish outlook. As Coinpedia reported, BTC price is likely to retest $92k before reaching $120k in the near term.