Bitcoin Open Interest Crashes 17% as Whales Scoop Up Supply—Reversal Ahead?

Bitcoin is continuing to face downward pressure in the market, with the cryptocurrency falling below $80,000 on Sunday for the first time since last year.

Despite a 4.1% recovery in the past 24 hours bringing it back to $79,825, Bitcoin remains down 26% from its all-time high of over $109,000 recorded in January 2025. Market sentiment remains mixed, as investors weigh on-chain data, short-term volatility, and the broader macroeconomic environment.

Bitcoin Open Interest Reflects Cautious Sentiment

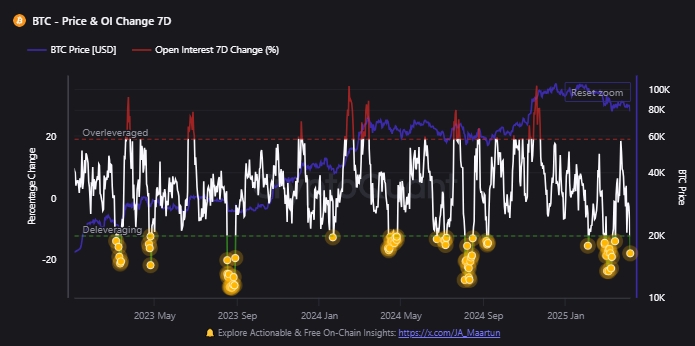

Bitcoin’s open interest metric has revealed cautious behavior among leveraged traders. CryptoQuant analyst Maartunn reported a 17.8% drop in Bitcoin open interest over the past week.

This decline represents a significant reduction in the number of outstanding derivative contracts and may reflect investor hesitation following recent price volatility.

Historically, such sharp declines in open interest have occurred before major market rebounds, as speculative leverage is flushed out of the system.

With leverage reset, market participants may begin re-entering positions, especially if prices find a strong support level or if further whale accumulation signals renewed bullish momentum.

Bitcoin Open Interest dropped -17.8%

This is over the last 7 days – shedding billions in leverage.

Over the last 2 years, these flush-outs often set the stage for major buy opportunity’s. pic.twitter.com/wXIxSXr7Nz

— Maartunn (@JA_Maartun) April 8, 2025

Accumulation Trends Signal Long-Term Confidence

Meanwhile, there has been a notable trend in the behavior of long-term holders and whales. According to on-chain data shared by CryptoQuant contributor Onchained, a substantial number of accumulating addresses have continued to buy Bitcoin aggressively even during the asset’s climb to new highs.

This cohort’s realized capitalization has surged from around $20 billion in 2023 to $160 billion in 2025, with BTC supply held by these entities increasing from approximately 800,000 to 3 million BTC.

This trend suggests that rather than scaling back during price increases, large holders significantly accelerated their buying efforts, indicating a high level of conviction. The analyst wrote:

This indicates the average acquisition price per bitcoin for accumulating addresses rose substantially, yet accumulation accelerated rather than slowed. A strong evidence of high-conviction buying regardless of price increases.

Onchained also noted a widening gap between retail and whale realized capitalization, pointing to the growing role of high-capital investors in market dynamics.

These whale wallets, typically less reactive to short-term market swings, are continuing to remove BTC from circulation, a pattern that may contribute to future supply constraints.

Onchained’s analysis further highlights three key implications: a growing supply-side pressure as more BTC enters inactive wallets, strong conviction from holders through all market phases, and the potential for future supply shocks as long-term accumulation continues.

Featured image created with Dall-E, Chart from TradingView