Bitcoin Experiences Impact of a $12B Short Squeeze: Here is How to Prepare for Imminent Crypto Summer

The post Bitcoin Experiences Impact of a $12B Short Squeeze: Here is How to Prepare for Imminent Crypto Summer appeared first on Coinpedia Fintech News

Bitcoin (BTC) price has closed above a crucial psychological barrier around $109k, which had held since December 2024 to date. The flagship coin surged over 3.8 percent in the past 24 hours to reach a new all-time high (ATH) of about $118,885, which was set during the mid-London session on Friday, July 11.

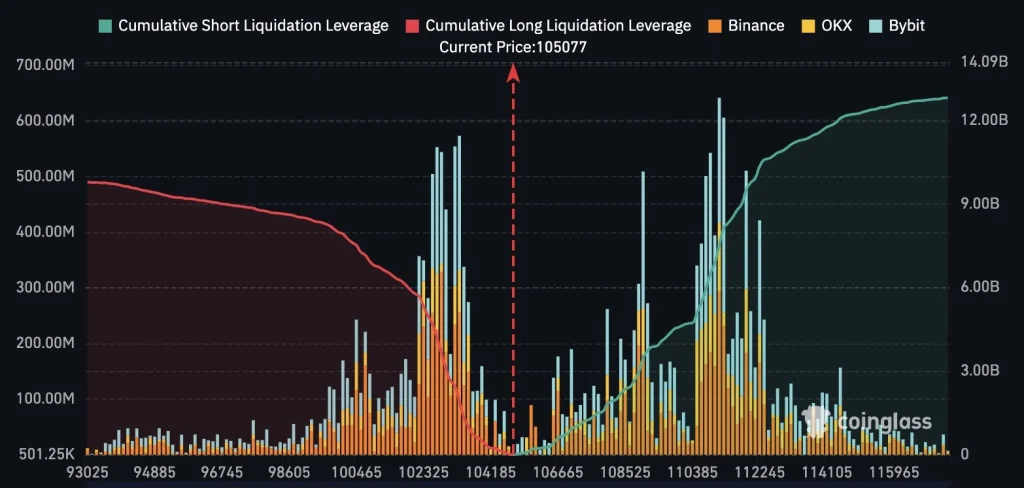

Following the sustained bullish sentiment, heavy crypto liquidations, amounting to over $1.2 billion, were recorded in the past 24 hours. Out of the entire crypto liquidations today, short trades amounted to over $1 billion, whereby BTC’s share was around $567 million.

As Coinpedia had previously reported, Bitcoin’s cumulative short liquidation leveraged trades entered at around $112k amounted to $12 billion. With Bitcoin price having surged above $118k, a short squeeze has been triggered and the sellers have now turned bullish.

Top Reasons Why Bitcoin Price Has More Upside Momentum

Bitcoin will continue to experience bullish sentiment in the coming months, largely fueled by rising demand from institutional investors. For instance, the U.S. spot BTC ETFs recorded the highest cash inflow, of about $1.18 billion in the past few months.

BlackRock’s IBIT has led in the net Daily Cash Inflow, whereby it currently has more than $80 billion in net cash under management. According to data compiled by BitcoinTreasuries, Strategy and Metaplanet have continued to lead dozens of companies holding BTC in their respective treasuries.

BTC price will continue to experience bullish sentiment fueled by the growing global money supply. Furthermore, more countries are forming alliances to ditch the U.S. dollar, as observed with the BRICS movement, thus weakening the greenback amid its ongoing depreciation.

How to Trade Crypto Summer

During a crypto summer, almost the entire crypto market experiences bullish sentiment fueled by sustained optimism and growth. Capital rotation happens from the largest crypto projects to the smallest by market cap.

From a technical analysis standpoint, considering oversold crypto tokens, including memecoin, with immense potential to disrupt the web3 space will likely offer higher returns. Moreover, the cryptocurrency market has a similar vibe in 2025 to the crypto summer of 2017, which resulted in one of the largest bull runs ever recorded.

The narrative is bolstered by the fact that the U.S. President Donald Trump ruled in 2017 and is the current leader.