Bitcoin Breakout Alert: Technicals Point Towards a New ATH—Here’s What’s Next!

The post Bitcoin Breakout Alert: Technicals Point Towards a New ATH—Here’s What’s Next! appeared first on Coinpedia Fintech News

Bitcoin (BTC) price has again stolen the spotlight, surging past a crucial resistance zone and igniting speculation: Could $110,000 be the next major milestone? With bullish technical patterns forming and on-chain data aligning, BTC’s price structure paints a promising picture, but not without a few caveats.

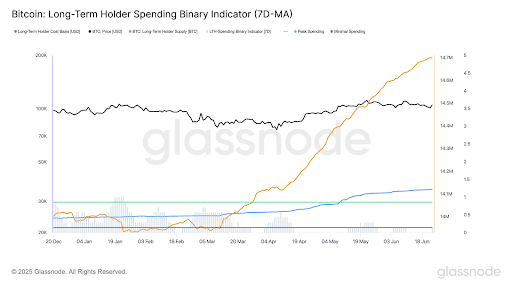

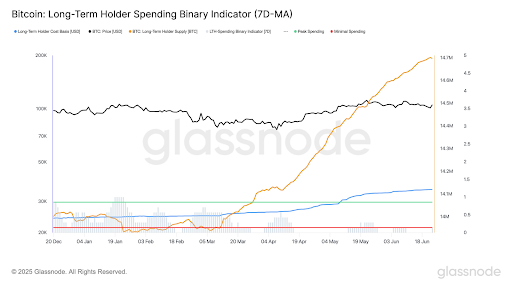

A recent report showed Bitcoin long-term holders are not distributing, which suggests the token is in a quiet accumulation phase. The lack of spikes in Dormancy flow reduces sell pressure from old coins, which could be a bullish signal for the token.

The data from Glassnode, the BTC long-term holder (LTH) spending binary indicator, shows minimal spending for the first time since June 10. With LTH supply near all-time highs at around 14.7 million BTC which signals conviction where the seasoned investors remain reluctant to distribute despite recent market volatility. Previously, the minimal long-term holder selling occurred post-March 2020 which set the stage for explosive rallies.

Bitcoin Price Prediction June 2025: Will BTC Price Reach $110K?

Bitcoin volatility has dropped below Gold for the first time ever, which signifies a historic shift in finance. This suggests that the star token is maturing and the market is recognizing it. Hence, as adoption grows and institutional confidence deepens, BTC could start to behave less like a wild rollercoaster and more like a stable store of value. As BTC price reclaimed $105K, and funding rates turned negative, there has been a classic set up of a short squeeze. With shorts piling in, history suggests an upward move could be imminent for Bitcoin & altcoins.

In the long term, the BTC price has approached a crucial resistance zone, which suggests a major breakout is underway. Previously, when the price reached the final resistance zone between $69,400 and $72,150. On the other hand, the weekly CMF dropped below the average and triggered a rebound, similar to what happened before the Q4 2024 rally. On the other hand, the weekly MACD which was on the verge of undergoing a bearish crossover, has displayed a bullish divergence.

Therefore, the Bitcoin (BTC) price is expected to accumulate along the resistance zone for a couple of weeks until the buying volume intensifies, followed by a breakout to a new ATH.