The State of Web3: A Global Look at Where Crypto Is Gaining Ground

The post The State of Web3: A Global Look at Where Crypto Is Gaining Ground appeared first on Coinpedia Fintech News

The Web3 ecosystem has gained significant traction in recent years, with more people across the world becoming everyday crypto users. According to the latest report by Crypto.com, the number of crypto owners across the world surged by 14% in 2024 to hit 659 million by the end of the year. The total market capitalization of digital assets has also doubled from $1.7 trillion at the onset of 2024 to around $3.3 trillion as of writing.

In this article, we’ll dive into some of the key growth trends in Web3, including where the most adoption has been happening, regulatory factors at play as well as the strategic role of retail-focused exchanges like XBO when it comes to onboarding more stakeholders from emerging markets like the LATAM region and EMEA.

Crypto Awareness is on an Uptrend in Emerging Economies

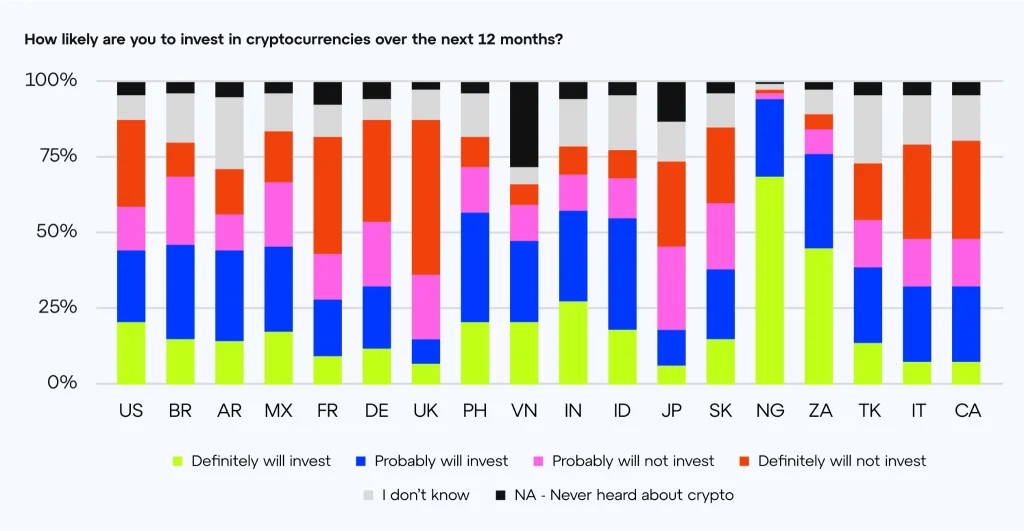

According to a recent Web3 global survey by Consensys, 93% of the people surveyed across the world are aware of crypto assets. What’s more intriguing, however, is the level of awareness in emerging countries; most of the respondents who claim to understand crypto were from Nigeria (77%), South Africa (65%) and India (60%).

At the same time, crypto ownership is also significantly higher in these emerging economies; Nigeria leads the pack again with the number of respondents who own or have previously owned crypto at 73%, South Africa (68%) the Philippines (54%), Vietnam (54%) and India (52%).

The percentage of Africans or Asians who intend to invest in crypto assets within the next one year was also significantly higher compared to other regions.

Source: Consensys

The U.S. Leads in Institutional Adoption, But Not Yet There…

According to Chainalysis ‘2024 Global Adoption Index’, the U.S ranked fourth in the overall indexing which comprised four major metrics; Centralized service value received ranking, Retail centralized service value received ranking, DeFi value received ranking, Retail DeFi value received ranking.

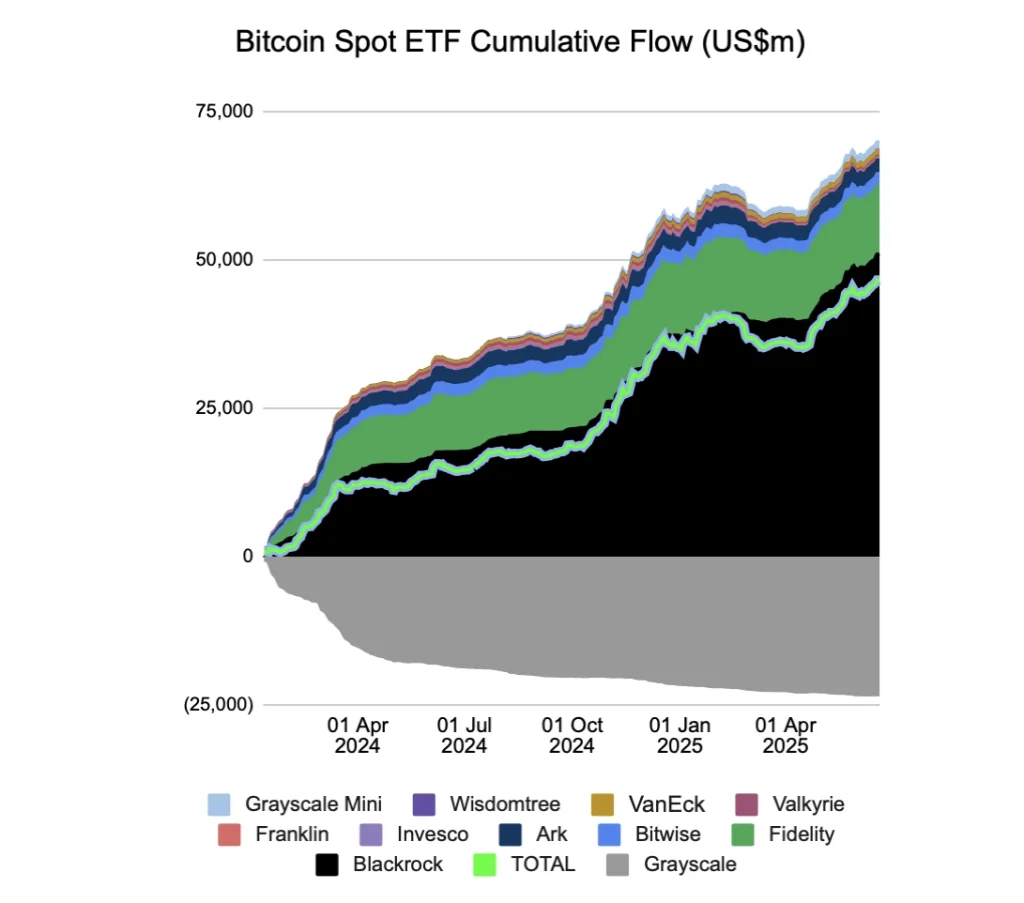

What stood out was the amount of institutional capital from U.S. companies that found its way into the crypto market. For context, Bitcoin Spot ETFs attracted over $129 billion in inflows between their launch date on January 10, 2024 and the close of the year.

Source: Farside

But despite the impressive institutional figures, it is worth noting that retail adoption isn’t picking up as much in the U.S. compared to the emerging economies mentioned above. This can be attributed to the uncertain regulatory environment compared to other advanced regions like Europe where MiCA provisions came into full application on December, 30 2024.

On the brighter side, the U.S. senate recently passed the Genius act which sailed through with a 68 – 30 vote; with the bill now going to the House, there is a good chance it will become the first of its kind stablecoin regulatory framework for companies looking to issue or manage this type of digital asset within the U.S.A. At the core, the Genius Act introduces clarity in stablecoin regulation, protecting consumers and reinforcing national security measures when dealing with stablecoins.

“The bipartisan GENIUS Act will provide regulatory clarity to this important industry, keep innovation on shore, add robust consumer protection, and reaffirm the dominance of the U.S. dollar,” – noted the co-sponsor of the bill, Sen. Kirsten Gillibrand (D-NY).

MiCA Framework Has Positioned Europe for Web3 Innovation

As mentioned in the previous section, the MiCA framework is now in full effect. While this regulation had earlier on been met with skepticism, more crypto companies are setting up shop in Europe thanks to the clarity it provides.

Some of the notable firms that have received a MiCA license since the framework was adopted include OKX which has established its European base in Malta, Crypto.com also a similar path during the same wave. Both crypto exchanges now have the flexibility to provide their services across the EU owing to the passporting provision for MiCA-licensed entities.

The latest survey on Web3 startups indicated that Europe tops the world with over 3900 crypto startups; while this number may have reduced as most of these companies were not MiCA-compliant at the time of the survey, it is evident that the clarity in registration has placed Europe ahead when it comes to Web3 innovation.

A Growing Market in LATAM Countries

Another worthy observation is the growing Web3 market in LATAM countries. Out of the top 20 in the Chainalysis adoption list, LATAM countries featured prominently with the likes of Brazil, Venezuela, Mexico and Argentina making the cut.

What’s particularly interesting in these markets is the levels at which adoption is happening. In Argentina for example, the football governing body, Argentine Football Association (AFA) has partnered with XBO, a leading digital crypto exchange focused on making digital asset trading secure, accessible and user-friendly.

This strategic partnership is testament to a growing demand by LATAM countries, from retail to institutions to governments like El Salvador which had already adopted Bitcoin as legal tender but dropped it earlier this year following pressure from the IMF.

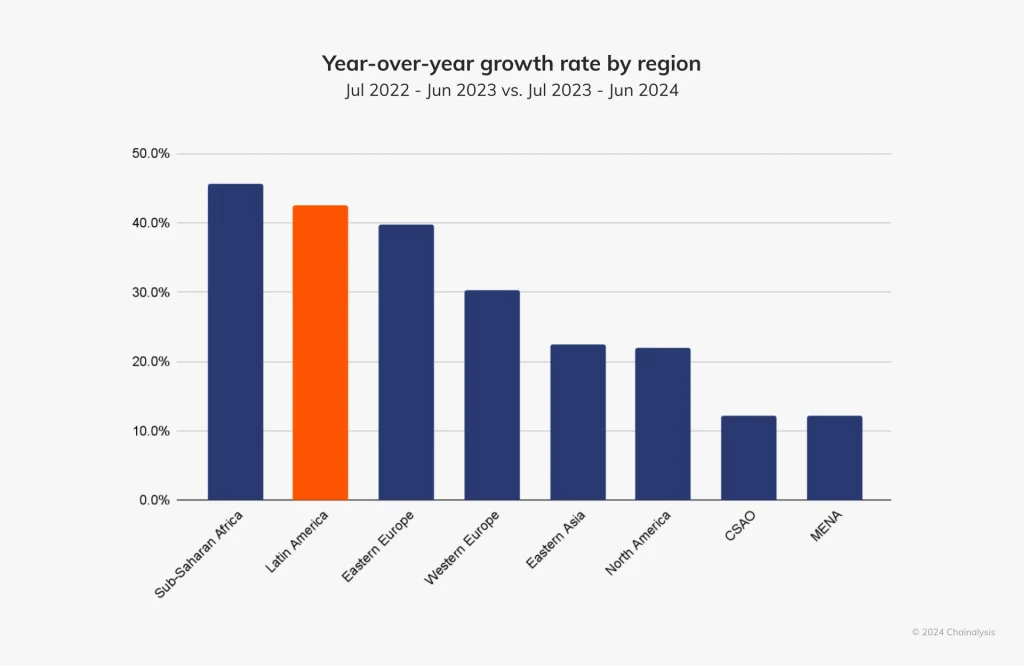

It is also worth noting that LATAM was the second faster growing region, with a 42.5% year-over-year growth in crypto adoption according to the Chainlysis report.

Source: Chainalysis

Conclusion

Web3 has come a long since Bitcoin’s debut in 2009; today, crypto is the only financial market globally that trades 24/7. But more importantly, we’re witnessing the adoption of Web3 both on a retail and institutional level. On the retail front, emerging economies are driving the metrics while advanced countries like the U.S. lead in institutional activity. The next decade will surely be interesting for Web3, it will be intriguing to witness how the latest regulatory developments steer adoption as well as the growing crypto use cases in the LATAM region, Africa and Central & Southern Asia and Oceania (CSAO).