Core Scientific Faces 55.7% Revenue Decline in Q1 2025 Amid Strategic Shift

Core Scientific (CORZ), a Bitcoin (BTC) mining company and high-density colocation services provider, has released its Q1 2025 financial report.

The report revealed a sharp 55.7% revenue decline. Despite the shortfall, the firm’s net income increased 175.6% in the same period.

Core Scientific Q1 2025 Report: Revenue Plunges Yet Net Income Surges

According to the report, the company’s revenue for the first quarter of 2025 was $79.5 million, down from $179.3 million in Q1 2024. Self-mining accounted for 84.5% of revenue ($67.2 million). Colocation contributed 10.8% ($8.6 million), and hosted mining contributed 4.7% ($3.8 million).

Additionally, the gross profit from digital asset self-mining dropped by $62.4 million, from $68.4 million (46% margin) in Q1 2024 to $6.0 million (9% margin) in Q1 2025. The decrease stems largely from reduced Bitcoin mining output, exacerbated by the April 2024 halving.

Furthermore, the company’s strategic pivot toward high-density colocation services was also a contributing factor.

“The decrease in Digital asset self-mining gross profit was primarily driven by a $82.8 million decrease in self-mining revenue, the result of a 75% decrease in bitcoin mined due to the halving and the operational shift to Colocation, partially offset by a 74% increase in the average price of bitcoin and a 33% decrease in power costs due to lower rates and usage,” the report read.

Notably, Core Scientific achieved a net income of $580.7 million, a significant increase from $210.7 million in the prior year. The rise was driven primarily by a $621.5 million non-cash mark-to-market adjustment related to warrants and other rights caused by the stock price drop.

A $16.3 million decrease in interest expenses also helped boost net income. However, this increase was partly offset by $111.4 million in costs related to the company’s emergence from bankruptcy in Q1 2024 and a $99.8 million drop in total revenue.

Moreover, operational challenges persist. The report revealed an operating loss of $42.6 million compared to a $55.2 million operating income in Q1 2024, and a negative adjusted EBITDA of $6.1 million, down from $88 million.

Despite this, it ended Q1 with $778.6 million in liquidity. Furthermore, the future outlook remains quite optimistic. Core Scientific is now prioritizing its partnership with CoreWeave, a high-performance computing provider.

It aims to deliver 250MW of billable capacity by year-end. This move is projected to generate annualized colocation revenue of $360 million by 2026.

“This quarter marks an inflection point for Core Scientific. In a matter of months, we have transformed vision into execution, delivering infrastructure at scale and positioning ourselves at the center of one of the most important shifts in modern computing. The pace of demand for high-performance data infrastructure is accelerating, and our ability to move with speed and precision is setting us apart,” Core Scientific’s CEO, Adam Sullivan, said.

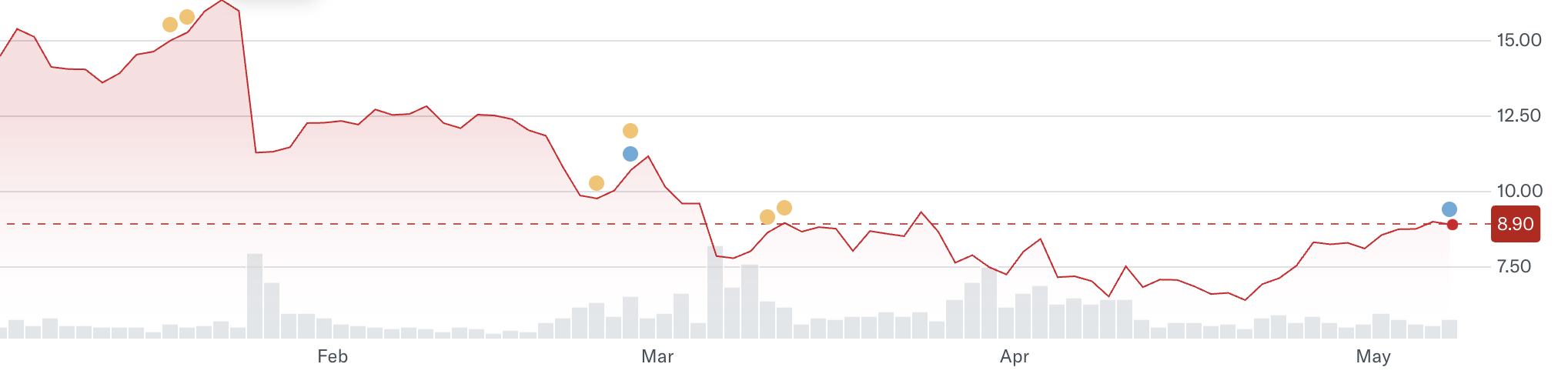

Meanwhile, along with the finances, Core Scientific’s stock (CORZ) has also faced headwinds since the beginning of the year. According to Yahoo Finance data, it has declined 36.6% year-to-date.

At market close, CORZ’s price was $8.9, a 1.0% decrease from the previous day. However, in pre-market trading, the stock price increased to $9.3, representing gains of 5.2%.

The post Core Scientific Faces 55.7% Revenue Decline in Q1 2025 Amid Strategic Shift appeared first on BeInCrypto.