Fidelity Investments Analyst Explains Why Bitcoin Adoption Has Slowed Down

Fidelity Investments’ Director of Global Macro, Jurrien Timmer, explains the recent slowdown in Bitcoin adoption.

While he acknowledges Bitcoin as “exponential gold” and a potential store of value, Timmer highlights the divergence between the deceleration in Bitcoin’s network growth and its price movements.

Network Growth vs. Price Gains

Timmer emphasized that Bitcoin’s price is primarily driven by its network growth, influenced by its scarcity, monetary and fiscal policies, and market sentiment. Despite Bitcoin’s price gains, its network growth has slowed. Such a dynamic created a divergence that may explain the recent slowdown in adoption.

In his tweets, Timmer illustrated how Bitcoin and Ethereum’s growth curves mirror historical technological advancements. He noted that Bitcoin’s network, represented by the number of non-zero addresses, has followed a power curve, with price oscillating around it. He further added that this boom-bust cycle is unique to Bitcoin.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

“In my view, this divergence between price and adoption could explain why Bitcoin has slowed down a bit along its path to potential new all-time highs. The pendulum will only swing so far. For the new highs to continue, the network may have to accelerate again. Could this be driven by the next chapter in the fiscal dominance thesis (i.e., monetary subordination)?” Timmer wrote.

Veteran trader Peter Brandt responded to Timmer’s insights by highlighting the diminishing gains in each bull market cycle. Brandt suggested that if the pattern continues, the current advance might be nearing its end.

“It makes sense, given the asymptotic nature of the power curve and the path of price discovery towards a mature asset,” Timmer replied to Brandt’s perspective.

Why Bitcoin’s Slow Circulation May Not Be a Bad Thing

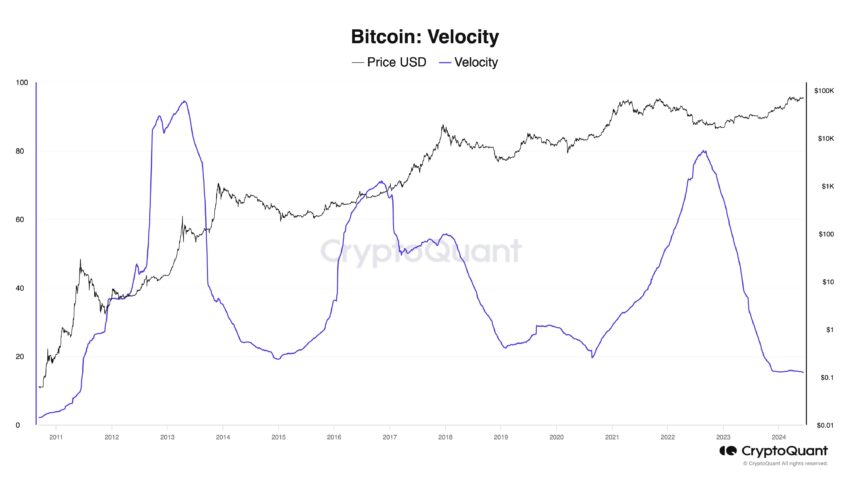

Ki Young Ju, founder and CEO of on-chain analytics platform CryptoQuant, also offered insights. Ju pointed out that Bitcoin’s circulation velocity has reached its lowest point since 2013. However, he thinks its velocity will peak someday when BTC is widely used for payments.

He argued that while Bitcoin was initially intended as “P2P Electronic Cash,” it has evolved into “Digital Gold,” with institutions holding it without frequent transactions. This shift in usage means that traditional Bitcoin adoption metrics may no longer be as relevant.

“With the rise of custodial wallets like ETFs, funds are concentrated in a few wallets. To assess the adoption curve accurately, separating cohorts for Bitcoin transactions as payments or using op_code to measure application usage might be more effective,” Ju noted.

Read more: How to Invest in Bitcoin?

Ju’s perspectives align with the broader trends of institutional interest in Bitcoin investments. For instance, Canadian fintech DeFi Technologies recently announced that it has adopted Bitcoin as the company’s treasury reserve, with an initial purchase of 110 BTC.

Similarly, since April, Japanese investment firm Metaplanet has adopted Bitcoin as its “core treasury reserve asset.” On June 11, the company announced that it had acquired another 23.35 BTC to its balance sheet, bringing its Bitcoin holdings to 141.07 BTC.

Indeed, experts’ insights and the current trend from institutional investors clarified the divergence between Bitcoin’s price and its network growth. Nonetheless, the changing uses of Bitcoin and the growing interest from institutions indicate that its story is far from finished.

The post Fidelity Investments Analyst Explains Why Bitcoin Adoption Has Slowed Down appeared first on BeInCrypto.