Ethereum Whale Buys $5.2M of ETH Post-Breakout, Eyes on $2,800

The post Ethereum Whale Buys $5.2M of ETH Post-Breakout, Eyes on $2,800 appeared first on Coinpedia Fintech News

It appears that Ethereum (ETH) is ready to take off, as investors’ and traders’ interest has skyrocketed in the past few days. On September 19, 2024, the on-chain analytic firm Lookonchain posted on X (Previously Twitter) that Ethereum Whale made a big bet by purchasing 2,117.7 ETH worth $5.17 million as the price surged.

Ethereum Whale Big Bet Amid Price Rally

According to the data, this whale is long on ETH through circular borrowing. The data also shows that this whale had liquidated a substantial 6,078 ETH worth $14.7 million when the overall market crashed on August 5, 2024.

Additionally, in the past six months, the whale went long ETH five times and liquidated four times, resulting in a loss of over $13 million. It appears that this time, due to the recent breakout and growing interest from investors and traders, the whale may recover all of their losses.

Ether Price Performance and Whale’s Recent Activity

Besides this whale’s massive purchase, on September 18, 2024, another whale bought 5,660 ETH worth $13.1 million at an average price of $2,316 level, as reported by CoinPedia. This data shows that whales have started accumulating ETH, indicating that a major rally may be imminent.

Currently, ETH is trading near $2,470 and has experienced a price surge of over 6% in the last 24 hours. During the same period, its trading volume increased by 16%, indicating higher participation from traders and investors amid ongoing price rallies.

Ethereum Technical Analysis and Upcoming Levels

According to the expert technical analysis, ETH appears bullish despite trading below the 200 Exponential Moving Average (EMA) on a daily time frame. The 200 EMA is a technical indicator used by investors and traders to determine whether an asset is in an uptrend or downtrend.

The potential reason for the bullishness is the recent breakout of the strong descending trendline that ETH has been facing since July 2024. However, this breakout isn’t confirmed until ETH closes its daily candle above the $2,485 level, if this happens, there is a strong possibility that ETH could soar to the $2,800 level in the coming days.

Bullish On-chain Metrics

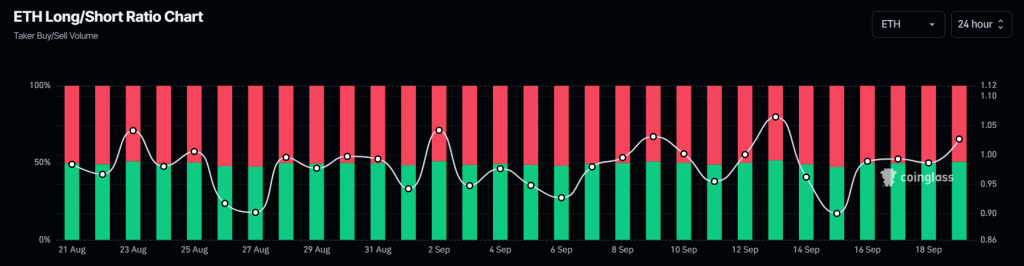

Besides this technical analysis, Coinglass’s ETH long/short ratio currently stands at 1.027, indicating bullish market sentiment among traders. The data also shows that 51% of top traders currently hold long positions, while 49% hold short positions.

This bullish thesis will only remain valid if ETH closes above the $2,800 level, otherwise, it may fail.